It might be hard to imagine now, but chances are you’ll need some help taking care of yourself later in life. The big question is: How will you pay for it?

Buying long-term care insurance is one way to prepare.

What is long-term care insurance?

Long-term care refers to a host of services that aren’t covered by regular health insurance. This includes assistance with routine daily activities, like bathing, dressing or getting in and out of bed.

A long-term care insurance policy helps cover the costs of that care when you have a chronic medical condition, disability or disorder such as Alzheimer’s disease. Most policies will reimburse you for care given in a variety of places, such as:

- Your home.

- A nursing home.

- An assisted living facility.

- An adult day care center.

- A skilled nursing facility.

Considering long-term care costs is an important part of any long-range financial plan, especially in your 50s and beyond. Waiting until you need care to buy coverage isn’t an option. You won’t qualify for long-term care insurance if you have a debilitating condition, and long-term care insurance carriers won’t approve most applicants older than 75. Most people with long-term care insurance buy it in their mid-50s to mid-60s.

Whether long-term care insurance is the right choice depends on your situation and preferences.

Before you shop for coverage, it’s important to learn more about the following topics:

- Why buy long-term care insurance?

- How long-term care insurance works

- Cost of long-term care insurance

- Tax advantages of buying long-term care insurance

- How to buy long-term care insurance

- Understanding state “partnership” plans

Why buy long-term care insurance?

Nearly 70% of 65-year-olds will eventually need long-term care services or support, according to 2020 data — the latest available — from the Administration for Community Living, part of the U.S. Department of Health and Human Services[1]. Women typically need care for an average of 3.7 years, while men require it for 2.2 years.

Regular health insurance doesn’t cover long-term care. And Medicare won’t come to the rescue, either; it covers only short nursing home stays or limited amounts of home health care in specific instances, such as for rehab after a hospital stay.

If you need custodial care, which includes supervision and help with day-to-day tasks, and you don’t have insurance to cover long-term care, you’ll have to pay for it yourself in most states. You can get help through Medicaid, the federal and state health insurance program for those with low incomes, but only after you’ve exhausted most of your savings.

People buy long-term care insurance for two reasons:

1. To protect savings. Long-term care costs can deplete a retirement nest egg quickly. The median cost of care in a semiprivate nursing home room is $94,900 per year, according to Genworth’s 2023 Cost of Care Survey[2].

ANNUAL MEDIAN COSTS OF LONG-TERM CARE IN 2023

| Home health aide | Homemaker services | Adult day health care | Assisted living facility | Nursing home care |

|---|---|---|---|---|

| $75,504. | $68,640. | $24,700. | $64,200 for a private one-bedroom. | $104,025 for a semiprivate room. $116,800 for a private room. |

2. To give you more choices for care. The more money you can spend, the better the quality of care you can get. If you have to rely on Medicaid, your choices will be limited to the nursing homes that accept payments from the government program. In many states, Medicaid doesn’t pay for all assisted living costs.

Buying long-term care insurance might not be affordable if you have a low income and little savings.

How long-term care insurance works

To buy a long-term care insurance policy, you fill out an application and answer health questions. The insurer may ask to see medical records and interview you by phone or in person.

You choose the amount of coverage you want. The policies usually cap the amount paid out per day and the amount paid during your lifetime.

Once you’re approved for coverage and the policy is issued, you begin paying premiums.

Under most long-term care policies, you’re eligible for benefits when you can’t do at least two out of six “activities of daily living,” called ADLs, on your own or you suffer from dementia or other cognitive impairment.

The activities of daily living are:

- Bathing.

- Caring for incontinence.

- Dressing.

- Eating.

- Toileting (getting on or off the toilet).

- Transferring (getting in or out of a bed or a chair).

When you need care and want to make a claim, the insurance company will review medical documents from your doctor and may send a nurse or other examiner to do an evaluation. Before approving a claim, the insurer must approve your plan of care.

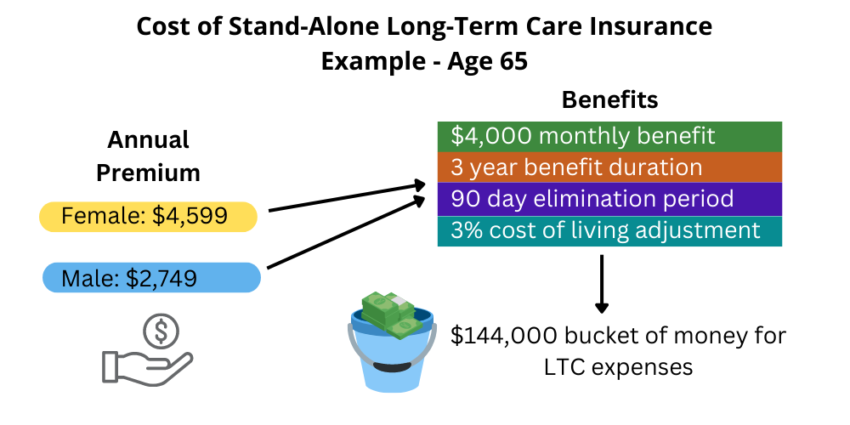

Under most policies, you’ll have to pay for long-term care services out of pocket for a certain amount of time, such as 30, 60 or 90 days, before the insurer starts reimbursing you for any care. This is called the “elimination period.”

The policy starts paying out after you’re eligible for benefits and usually after you receive paid care for that period. Most policies pay up to a daily limit for care until you reach the lifetime maximum. If you use less than the daily limit, you can typically spend the balance after the initial elimination period — in other words, coverage isn’t “use it or lose it.”

Some companies offer a shared care option for couples when both spouses buy policies. This lets you share the total amount of coverage, so you can draw from your spouse’s pool of benefits if you reach the limit on your policy.